Get the free ob12 form

Show details

Application to amend authorization to import and market in the EU organic products from Third Countries according to Article 11 (6) Regulation (EC) 2092/91 Ref no. Important

? ? ? This application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

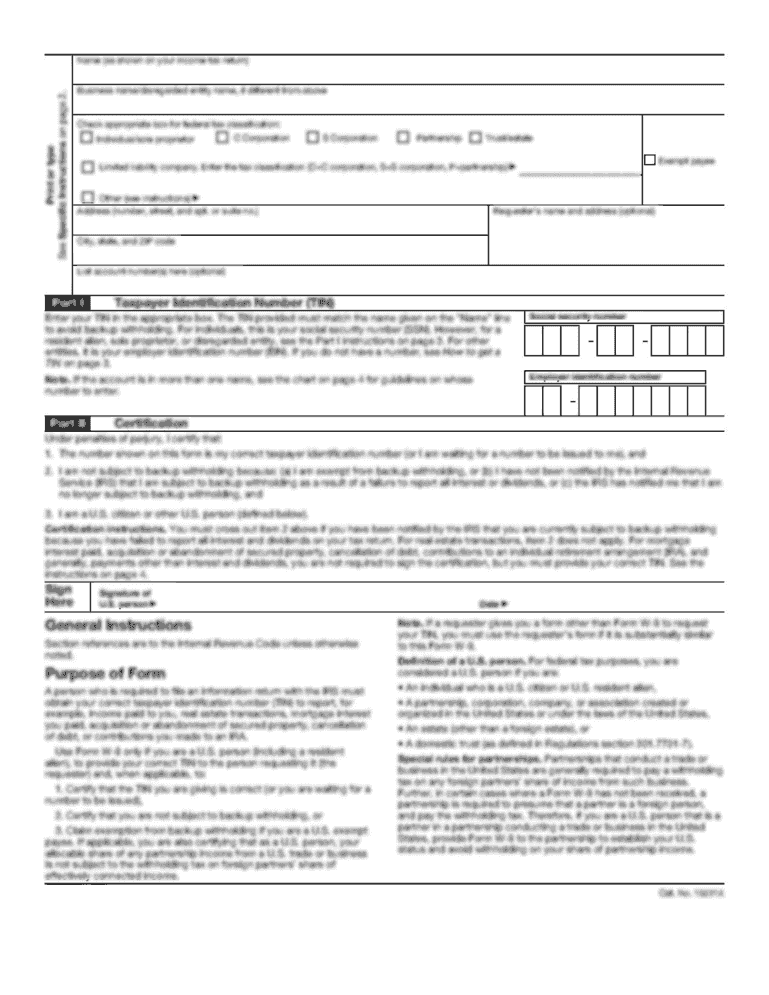

Edit your ob12 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ob12 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ob12 form online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit st john ambulance ob12 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out ob12 form

How to fill out ob12 form?

01

Start by gathering all the necessary information and documents required for the form. This may include personal identification details, financial information, and any relevant supporting documents.

02

Carefully read the instructions provided with the ob12 form to understand the specific requirements and guidelines for filling it out. Make sure you have a clear understanding of what information is needed and how it should be provided.

03

Begin filling out the form systematically, following the order of the sections or fields provided. Double-check that you are entering accurate and up-to-date information.

04

Pay attention to any special instructions or additional documentation that may be required for certain sections of the form. If there are any confusing or unclear instructions, seek clarification from the relevant authority or consult a professional if necessary.

05

Ensure that you provide all the necessary supporting documents as required. These may include proof of income, bank statements, tax returns, or any other relevant paperwork. Make sure to attach these documents securely to the form.

06

Review the completed form to ensure that all the fields are filled out accurately and completely. Double-check for any errors or missing information. It's crucial to provide correct information to avoid any delays or issues with the processing of your form.

07

Once you have reviewed the form and attached all supporting documents, sign and date the form as required. Make sure your signature is clear and legible.

Who needs ob12 form?

01

The ob12 form may be required by individuals or businesses who need to report certain financial information to the relevant authorities. It could be mandatory for tax purposes, financial statements, or any other specific requirements based on local regulations.

02

People who are self-employed, freelancers, or have income from sources other than regular employment may need to fill out the ob12 form to accurately report their financial situation.

03

Businesses, especially small businesses or sole proprietors, may also need to submit the ob12 form to meet their tax obligations or provide financial statements to regulatory bodies.

Note: The specific requirements and individuals who need the ob12 form may vary depending on the jurisdiction and local laws. It is recommended to consult with a tax professional or relevant authority to determine if you need to fill out the ob12 form in your specific situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ob12 form?

The term "OB12 form" does not have a clear and specific meaning. It could be a specific form used in a particular context or organization. More information is needed to provide a more accurate answer.

Who is required to file ob12 form?

The OB12 form, also known as the Certificate of Tax Deducted at Source for Existing Entities, is required to be filed by entities that have deducted tax at source under the Income Tax Act, 1961. This includes organizations such as companies, government departments, agencies, and individuals who are responsible for deducting tax at source from payments made to contractors, professionals, or any other income recipients as mandated by the tax laws in their country.

How to fill out ob12 form?

To correctly fill out an OB12 form, which is used for filing taxes in Ontario, Canada, you will need to follow these steps:

1. Obtain the form: Download a copy of the OB12 form from the Canada Revenue Agency (CRA) website or get a physical copy from a CRA office.

2. Personal information: Fill in your personal details at the top of the form, including your name, address, social insurance number (SIN), and contact information.

3. Tax year: Indicate the tax year you are filing for by entering the applicable dates (e.g., January 1, 2021, to December 31, 2021).

4. Income: Report your income from all sources in the appropriate sections. This may include employment income, self-employment income, investment income, rental income, and other types of income. Provide the necessary details such as amounts, sources, and any applicable deductions or credits.

5. Federal information: Transfer income and deductions from your federal tax return to the designated areas on the form. This information can typically be found on your federal tax return documents.

6. Tax credits: Determine if you are eligible for any tax credits, such as the Ontario Trillium Benefit, and complete the corresponding sections. Make sure to read the instructions and guidelines carefully to accurately report your eligibility and entitlement.

7. Municipal, school, and university taxes: Report any municipal and school taxes you owe or payments you have made. If you paid university fees that qualify for a tax credit, make sure to include them in the relevant section.

8. Donations and gifts: If you made any charitable donations or gifts during the tax year, fill out the corresponding section. Include the names of the organizations, amounts donated, and supporting documentation, such as official receipts.

9. Sign and date the form: Ensure you sign and date the form to certify its accuracy. If filing jointly with a spouse or common-law partner, both individuals should sign and date the form.

10. Submission: Keep a copy of the completed form for your records and send the original to the CRA according to the provided instructions. Typically, the form can be submitted online through the CRA's My Account portal, by mail, or drop-off at a designated CRA office.

Remember to carefully review the instructions and guidelines provided with the OB12 form to accurately complete and submit your tax return. Additionally, it may be beneficial to consult a tax professional or accountant for personalized assistance with your tax filing.

What is the purpose of ob12 form?

The term "OB12 form" does not refer to any specific form that is widely known or recognized. It is possible that it could be a form or document specific to a certain organization, company, or industry. Without further context or information, it is difficult to determine the exact purpose of an OB12 form.

What information must be reported on ob12 form?

The OB12 form, also known as the Occupational Injury and Illness Incident Report, should contain the following information:

1. Employer information: Name, address, and other contact details of the employer.

2. Employee information: Name, job title or occupation, and other relevant details of the injured employee.

3. Injury or illness details: Description of the injury or illness, including the affected body part(s) or system(s), cause of the incident, and any contributing factors.

4. Date and time of incident: The specific date and time when the incident occurred.

5. Location of incident: The place or area where the incident occurred, including the address or specific work site.

6. Witnesses: Names and contact details of any witnesses to the incident.

7. Treatment provided: Details of the initial medical treatment given to the injured employee, including the healthcare provider's name and address.

8. Injury severity: The seriousness of the injury or illness, whether it required hospitalization, resulted in permanent disability, or led to loss of work time.

9. Notification: Whether the incident was reported to the appropriate regulatory authority or governing body as required by law or company policy.

10. Investigation: Any steps taken to investigate the incident, including interviews conducted or evidence collected.

11. Preventative measures: Any actions taken or recommendations made to prevent similar incidents from occurring in the future.

12. Supervisor's comments: Any additional comments or details provided by the employee's supervisor or manager.

13. Signature: The signature of the person completing the form, along with the date of completion.

These are general guidelines, and specific reporting requirements may vary depending on the country, regulatory body, or organization. It is important to consult the relevant authorities and guidelines to ensure compliance with reporting obligations.

How do I edit ob12 form online?

With pdfFiller, it's easy to make changes. Open your st john ambulance ob12 form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit ob12 form straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing st john ambulance ob12 form right away.

How do I edit ob12 form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute st john ambulance ob12 form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your ob12 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.